Green Fuel Technologies: Power-to-X – Converting Renewable Electricity into Green Fuels

- Green Fuel Journal

- Nov 3, 2025

- 16 min read

The maritime shipping industry stands at a crossroads. With over 90% of global trade traveling by sea, the sector produces nearly 3% of worldwide carbon emissions—equivalent to the entire carbon footprint of Germany. Traditional marine fuels cannot power a carbon-neutral future, yet battery technology cannot propel massive cargo vessels across oceans. This fundamental challenge exemplifies why green fuel technologies, particularly the Power-to-X (PtX) pathway, have become essential for achieving global climate targets.

Green fuel technologies represent humanity's systematic approach to replacing fossil fuels with carbon-neutral or carbon-negative alternatives. These technologies encompass various pathways—from biofuels derived from organic matter to synthetic fuels created through advanced chemical processes. Among these solutions, Power-to-X renewable electricity conversion stands as arguably the most versatile and scalable approach, offering a bridge between abundant renewable energy generation and sectors that cannot easily electrify.

The PtX concept is elegantly simple yet profoundly transformative: convert surplus renewable electricity into storable, transportable chemical energy carriers. When wind turbines spin faster than the grid requires or solar panels generate excess midday power, PtX technologies capture this energy and transform it into hydrogen, ammonia, methanol, or synthetic liquid fuels. These products can then power ships, aircraft, industrial furnaces, and chemical plants—applications where batteries remain impractical.

This article explores the complete landscape of Power-to-X renewable electricity conversion within the broader green fuel technologies ecosystem. We examine the technical pathways from renewable electrons to usable fuels, assess real-world applications across hard-to-decarbonize sectors, analyze the economic barriers and policy frameworks necessary for scale-up, and outline strategic approaches for businesses and governments pursuing this critical decarbonization pathway.

Positioning PtX within Green Fuel Technologies

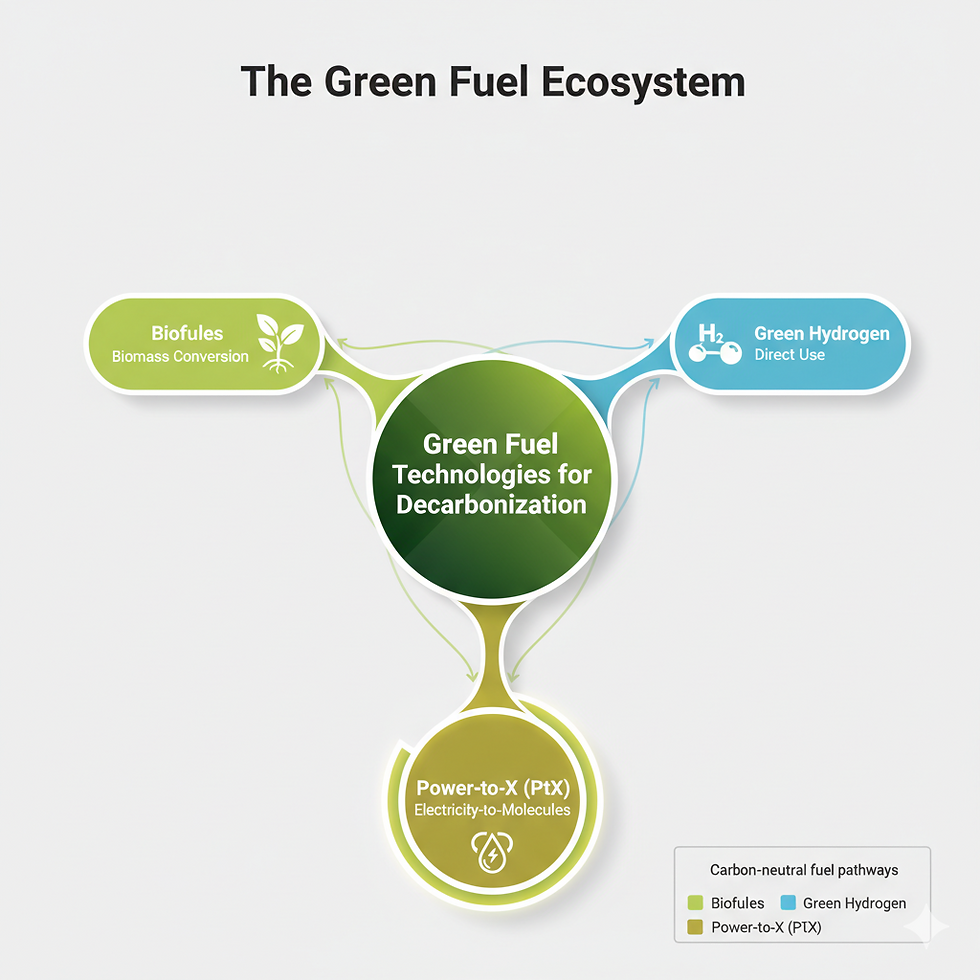

Understanding Power-to-X requires first mapping the broader green fuel technologies landscape. This ecosystem contains three primary branches, each addressing different aspects of the global decarbonization challenge.

Biofuels represent the first generation of renewable fuel alternatives, converting biomass—agricultural residues, dedicated energy crops, algae, or organic waste—into liquid or gaseous fuels through biological or thermochemical processes. These fuels integrate relatively easily into existing infrastructure but face scalability constraints due to land use requirements and competition with food production.

Green hydrogen serves as both a standalone fuel and a fundamental building block for more complex energy carriers. Produced through water electrolysis powered by renewable electricity, green hydrogen offers zero-emission energy for specific applications while providing the chemical foundation for synthesizing other fuels.

Power-to-X technologies occupy a unique position, functioning as the conversion bridge between variable renewable electricity and molecular energy carriers. PtX encompasses the entire chain: renewable power generation, electrolysis to produce green hydrogen, and subsequent synthesis into various fuel products including e-methanol, green ammonia, sustainable aviation fuel, and synthetic diesel.

The strategic importance of PtX becomes clear when examining sector-specific decarbonization challenges. Direct electrification works brilliantly for passenger vehicles and certain industrial processes. However, international shipping, long-haul aviation, steel production, and ammonia synthesis require energy-dense fuels or chemical feedstocks that batteries cannot provide. Power-to-X renewable electricity conversion fills this gap, enabling these sectors to achieve carbon neutrality without abandoning proven equipment and infrastructure.

The PtX pathway offers a crucial advantage: geographical flexibility. Nations with exceptional renewable resources—abundant wind in Patagonia, intense solar radiation in Australia, or hydropower in Norway—can become green fuel exporters, shipping synthesized products globally through existing fuel distribution networks. This transforms energy geopolitics, creating opportunities for resource-rich developing nations while providing energy security for import-dependent economies.

Technology Pathways of Power-to-X

Renewable Electricity → Electrolysis → Green Hydrogen

The foundation of all Power-to-X pathways begins with electrolysis—the process of splitting water molecules (H₂O) into hydrogen (H₂) and oxygen (O₂) using electrical current. When this electricity comes from renewable sources, the resulting hydrogen qualifies as "green," carrying no carbon footprint beyond the initial manufacturing of the electrolyzer equipment.

Three primary electrolyzer technologies dominate the market, each with distinct characteristics:

Alkaline Electrolyzers represent the most mature and cost-effective technology. Operating at lower temperatures (60-80°C) with potassium hydroxide solution as the electrolyte, alkaline systems achieve good efficiency (60-70%) and can be built at large scales. Their main limitation involves slower response times to power fluctuations, making them less ideal for directly coupling with variable renewable sources like wind or solar.

Proton Exchange Membrane (PEM) Electrolyzers use a solid polymer electrolyte, enabling faster startup times and superior response to power variations. These characteristics make PEM technology particularly valuable for green fuel technologies requiring dynamic operation. PEM systems achieve slightly higher efficiency (65-75%) and produce ultra-pure hydrogen. However, they currently cost more than alkaline alternatives and rely on rare platinum group metals as catalysts.

Solid Oxide Electrolyzer Cells (SOEC) represent the frontier of efficiency, operating at high temperatures (700-900°C) and achieving electrical efficiencies exceeding 80%. SOEC systems can utilize waste heat from industrial processes, dramatically improving overall system efficiency. The technology remains in earlier development stages, with durability and cost reduction as primary research focuses.

The economics of green hydrogen production have transformed dramatically. Between 2019 and 2024, the levelized cost of renewable electricity—particularly from solar photovoltaic and onshore wind—dropped by approximately 40-60% in many regions. According to the International Renewable Energy Agency (IRENA), renewable electricity costs in optimal locations now regularly fall below $20 per megawatt-hour, with some markets achieving under $15/MWh during surplus generation periods.

Simultaneously, electrolyzer costs declined by roughly 35% from 2020 to 2024, driven by manufacturing scale-up, supply chain optimization, and technological improvements. Industry projections suggest green hydrogen production costs could reach $1-2 per kilogram by 2030 in favorable locations—approaching cost parity with hydrogen produced from fossil fuels without carbon capture.

These converging trends make the first step of Power-to-X renewable electricity conversion—green hydrogen production—increasingly economically viable. The challenge shifts to the next stage: converting that hydrogen into more practical fuel forms.

Green Hydrogen → Synthetic Fuels (e-Methanol, Green Ammonia) & Other Carriers

Green hydrogen serves as an exceptional energy carrier in specific applications but faces practical limitations: low volumetric energy density, storage complexity requiring high pressure or cryogenic temperatures, and infrastructure challenges. Converting hydrogen into other molecular forms addresses these constraints while enabling green fuel technologies to serve diverse end-use sectors.

Green Ammonia (NH₃) emerges through the Haber-Bosch process, combining green hydrogen with nitrogen extracted from air. This century-old industrial process, originally designed for fertilizer production, now positions ammonia as a leading carbon-neutral fuel technology for maritime shipping. Ammonia contains no carbon atoms, eliminating CO₂ emissions during combustion (though requiring careful management of potential nitrogen oxide emissions). It liquefies at moderate pressures or -33°C, making storage and transport far simpler than hydrogen. Major shipping companies including Maersk have ordered ammonia-powered vessels for deployment by 2025-2026, with deliveries already underway.

e-Methanol (CH₃OH) represents another promising pathway within Power-to-X systems. Synthesis combines green hydrogen with captured carbon dioxide or carbon monoxide, typically using copper-zinc catalysts at 200-300°C and moderate pressures. The resulting methanol serves as a liquid fuel compatible with modified combustion engines or as a chemical feedstock. Methanol's liquid state at ambient conditions, existing global distribution infrastructure, and relatively straightforward engine modifications make it attractive for shipping and potentially ground transport. The carbon required for e-methanol production can come from biogenic sources (creating a closed carbon cycle), direct air capture, or industrial CO₂ emissions streams.

Synthetic Aviation Fuel (SAF) via Fischer-Tropsch addresses aviation's decarbonization challenge. The Fischer-Tropsch synthesis converts green hydrogen and CO₂ into long-chain hydrocarbons chemically identical to conventional jet fuel. These "drop-in fuels" require zero modifications to aircraft engines or fuel systems, enabling immediate adoption. The process operates at 200-350°C with iron or cobalt catalysts, building hydrocarbon molecules from the ground up. Airlines globally have committed to achieving 10% SAF utilization by 2030, creating substantial market demand for green fuel technologies.

Power-to-Liquids (PtL) Diesel and Gasoline employ similar synthesis routes, creating renewable replacements for conventional transportation fuels. These synthetic fuels burn cleaner than petroleum products, eliminating sulfur and reducing particulate emissions while maintaining full compatibility with existing vehicle fleets and distribution infrastructure.

The "drop-in fuel" concept represents a strategic advantage for Power-to-X renewable electricity conversion. Rather than requiring trillions of dollars in infrastructure replacement—new pipelines, storage tanks, vehicle engines, and fueling stations—synthetic fuels utilize existing assets. This dramatically accelerates deployment timelines and reduces transition costs.

Technology Readiness of Key PtX Products Table:

Notes / citation points:

The TRL concept (Technology Readiness Level) is a widely accepted metric for technology maturity.

Specific TRL references for PtX products such as green ammonia and e-methanol appear in emerging research: e.g., “Green methanol and ammonia as emerging green fuels” mentions maturity levels.

Infrastructure & Storage Considerations

The practical success of green fuel technologies depends critically on infrastructure requirements. Green hydrogen faces significant hurdles: storage requires compression to 350-700 bar pressures or liquefaction at -253°C, both energy-intensive processes. Pipeline transport necessitates specialized materials to prevent hydrogen embrittlement. These factors limit hydrogen's practical distribution radius and increase handling costs.

Synthetic liquid fuels largely circumvent these challenges. Methanol, synthetic diesel, and jet fuel store at ambient conditions in conventional tanks, transport via existing pipelines and tanker ships, and dispense through current refueling infrastructure. This infrastructure compatibility accelerates the Power-to-X deployment timeline significantly.

Green ammonia occupies a middle position—easier to handle than hydrogen but requiring more specialized infrastructure than liquid hydrocarbons. The global ammonia industry already possesses substantial production and distribution infrastructure, primarily serving agricultural markets. Expanding this network for energy applications requires investment but builds on proven systems.

Region-specific insight for India and broader Asia: India's commitment to green hydrogen production aligns strategically with Power-to-X deployment, particularly for green ammonia. As the world's second-largest consumer of nitrogenous fertilizers, India currently imports substantial quantities. Domestic green ammonia production could simultaneously advance agricultural self-sufficiency and decarbonization goals. The National Green Hydrogen Mission, launched in 2023, targets 5 million tonnes of annual green hydrogen production by 2030. Converting a significant portion to green ammonia addresses both the fertilizer sector's carbon footprint (conventional ammonia production generates roughly 2% of global CO₂ emissions) and creates export opportunities to Northeast Asian markets increasingly demanding carbon-neutral fuel technologies for shipping and power generation.

Similarly, Southeast Asian nations with exceptional renewable resources—particularly Indonesia, Vietnam, and the Philippines—are positioning themselves as potential green fuel exporters to energy-hungry neighbors including Japan, South Korea, and Singapore.

Applications & Market Opportunities

The true measure of green fuel technologies lies in their ability to decarbonize sectors where electrification proves impractical or impossible. Power-to-X renewable electricity conversion targets four primary application categories:

Maritime Shipping represents the most immediate and substantial opportunity. International shipping transported approximately 11 billion tonnes of cargo in 2023, almost entirely powered by heavy fuel oil and marine diesel. The International Maritime Organization's regulations require reducing shipping emissions by at least 50% by 2050 compared to 2008 levels, with increasingly aggressive interim targets. Battery-electric propulsion cannot serve transoceanic routes requiring multi-week voyage times and massive energy storage. Green ammonia and e-methanol emerge as the leading carbon-neutral fuel candidates, with shipbuilders actively developing engines and receiving orders for both fuel types.

Aviation faces perhaps the most constrained decarbonization pathway. Aircraft require extremely high energy density fuels—conventional jet fuel contains roughly 100 times the energy per kilogram of the best lithium-ion batteries. Sustainable Aviation Fuel produced via Fischer-Tropsch Power-to-X processes offers the only currently viable path to carbon-neutral flying. The global SAF market, essentially zero in 2020, reached approximately 600 million liters in 2024. Industry projections suggest demand exceeding 30 billion liters annually by 2030, representing roughly 10% of total jet fuel consumption. At current wholesale prices of $3-5 per liter for SAF versus $0.75-1.25 for conventional jet fuel, closing this cost gap requires either carbon pricing mechanisms or regulatory mandates—both increasingly being implemented.

Industrial Feedstocks consume vast quantities of hydrogen and methanol for chemical production. Currently, approximately 95% of this hydrogen comes from steam methane reforming of natural gas, generating roughly 900 million tonnes of CO₂ annually—equivalent to the emissions of the entire aviation and maritime shipping sectors combined. Steel production represents another major opportunity, with hydrogen-based direct reduction offering a pathway to eliminate blast furnace coal consumption. European steelmakers including SSAB, ArcelorMittal, and ThyssenKrupp have announced green steel projects utilizing green hydrogen, with first production already underway.

Energy Storage & Grid Balancing constitutes a fourth, often overlooked application. While lithium-ion batteries excel at short-duration storage (hours to days), seasonal energy storage—capturing summer renewable abundance for winter demand—requires different solutions. Converting surplus renewable electricity to ammonia, methanol, or hydrogen, storing these fuels for months, then reconverting to electricity or using directly as fuels provides cost-effective seasonal storage. This application grows increasingly valuable as renewable generation expands beyond immediate grid capacity.

Market & Case Study: The green hydrogen market alone reached approximately $4.8 billion in 2023, with projections suggesting growth to $139 billion by 2032—a compound annual growth rate exceeding 38%, according to multiple industry analyses. The e-fuels market, encompassing synthetic aviation fuel, e-methanol, and e-diesel, shows similar explosive growth trajectories.

A landmark Power-to-X facility exemplifies this emerging industry: The Haru Oni project in Chilean Patagonia, developed by a consortium including Siemens Energy, Porsche, and ExxonMobil. This integrated facility combines wind power generation, electrolysis, and methanol synthesis, with further refining to produce synthetic gasoline. Beginning pilot operations in 2022 and expanding progressively,

Haru Oni demonstrates the complete green fuel technologies value chain in a region with exceptional wind resources (capacity factors exceeding 60%). Initial production targets modest volumes—approximately 550,000 liters annually in the first phase—but the project validates technical integration and provides operational learning for subsequent gigawatt-scale facilities planned across Chile, which possesses arguably the world's best combined solar and wind resources for Power-to-X renewable electricity conversion.

Cost, Policy & Scale-Up Challenges

Despite technical maturity and growing demand, green fuel technologies face substantial economic barriers that currently prevent widespread deployment. Understanding the cost structure reveals where intervention can accelerate progress.

The total cost of Power-to-X products breaks into three primary components:

Renewable Electricity Cost typically represents 40-60% of total production expenses. As noted previously, optimal locations now achieve levelized electricity costs below $20/MWh, but global averages remain substantially higher. Round-the-clock operation of electrolyzers and synthesis equipment maximizes capital utilization, but renewable sources provide variable output. Solving this tension requires either electricity storage (adding cost) or accepting lower equipment utilization rates.

Electrolyzer & Hydrogen Production Cost contributes 20-35% of total expenses. Current electrolyzer capital costs range from $500-1,200 per kilowatt of capacity, depending on technology and scale. Industry targets aim for under $300/kW by 2030. Operational costs include water (minor for most locations), maintenance, and stack replacement. Green hydrogen production costs currently span $3-8 per kilogram globally, though falling toward $2-3/kg in optimal regions with dedicated renewable generation.

Synthesis & Processing Cost adds the final 20-40%, varying significantly by product complexity. Converting hydrogen to ammonia via Haber-Bosch adds relatively modest costs given the mature industrial process. Fischer-Tropsch synthesis for aviation fuel proves more expensive due to process complexity and multiple refining steps. Additionally, CO₂ sourcing for hydrocarbon fuels adds costs—whether capturing from point sources ($50-100/tonne), utilizing biogenic sources, or employing direct air capture ($300-600/tonne currently, targeting under $200/tonne by 2030).

Comparing these costs to conventional fuels reveals the challenge: Petroleum products enjoy over a century of infrastructure optimization, massive economies of scale, and absent carbon pricing. Conventional jet fuel costs $0.75-1.25 per liter; synthetic aviation fuel costs $3-5 per liter. Marine fuel oil trades around $600-700 per tonne; green ammonia production costs currently exceed $800-1,200 per tonne as fuel equivalent.

Bridging this cost gap requires strategic policy intervention. Multiple mechanisms show promise:

Carbon Pricing internalizes environmental costs, making fossil fuels bear their true societal expense. The European Union's Emissions Trading System reached €80-100 per tonne CO₂ in 2024, significantly improving green fuel competitiveness. More aggressive pricing accelerates transition timelines.

Regulatory Mandates force adoption regardless of cost differentials. The EU's ReFuelEU Aviation regulation requires 2% SAF blending by 2025, rising to 70% by 2050. Similar mandates for maritime fuels (FuelEU Maritime) and renewable hydrogen in industry drive guaranteed demand, enabling investment in production capacity.

Production Subsidies & Tax Credits directly reduce costs. The United States Inflation Reduction Act provides tax credits up to $3 per kilogram for qualifying green hydrogen production, dramatically improving project economics. India's Green Hydrogen Mission includes similar incentive structures.

Infrastructure Investment by governments reduces private sector barriers. Public funding for CO₂ capture networks, hydrogen pipelines, and ammonia bunkering facilities accelerates ecosystem development.

The scalability challenge cannot be understated. Current global green hydrogen production capacity totals approximately 0.7 million tonnes annually—less than 1% of total hydrogen production. Achieving climate targets requires increasing this by roughly 100-fold by 2050. Similarly, current PtX fuel production measures in thousands of tonnes annually; decarbonizing shipping and aviation requires billions of tonnes. This scaling demands unprecedented manufacturing growth for electrolyzers, synthesis equipment, and renewable generation capacity.

Strategic Implications & Business Models

Organizations across the energy value chain face strategic choices regarding Power-to-X engagement. Early movers gain competitive advantages, but timing and partnership structures critically influence success.

Five Strategic Actions for Key Stakeholders:

Renewable Power Generators & Utilities: Secure land and grid connections in high-quality renewable resource zones with access to water and potential industrial off-takers. Vertical integration into green fuel technologies production captures additional value and provides demand stability for variable renewable generation. Establish long-term power purchase agreements (PPAs) with PtX developers at prices enabling project viability.

Governments & Policymakers: Implement clear, long-term policy frameworks including carbon pricing, blending mandates, and production incentives. Standardize life-cycle carbon accounting methodologies for Power-to-X products to ensure environmental credibility and prevent greenwashing. Invest in enabling infrastructure—CO₂ transport networks, hydrogen pipelines, port bunkering facilities. Facilitate international cooperation on fuel standards and certification systems.

Traditional Fuel Producers & Energy Companies: Diversify portfolios by investing in green fuel technologies production, either through internal development or joint ventures with renewable developers. Leverage existing customer relationships, distribution infrastructure, and engineering expertise. Establish off-take agreements securing long-term supply of PtX products to meet corporate decarbonization commitments.

Industrial Consumers (Shipping, Aviation, Chemicals, Steel): Form strategic partnerships ensuring fuel supply security. Co-invest in production facilities to secure preferential pricing and volumes. Participate in industry consortia developing technical standards and best practices for carbon-neutral fuel technologies. Integrate PtX planning into long-term capital expenditure decisions for vessels, aircraft, and industrial facilities.

Equipment Manufacturers & Technology Developers: Scale manufacturing capacity aggressively while reducing costs through learning-by-doing and supply chain optimization. Focus R&D on efficiency improvements, operational flexibility, and longevity. Develop integrated system offerings rather than standalone components. Establish local manufacturing in regions with strong renewable resources to capture emerging markets in Latin America, Middle East/North Africa, Australia, and India.

Joint ventures represent particularly attractive structures, combining renewable developers' expertise in power generation, chemical companies' process engineering knowledge, and end-users' market understanding. Several successful models have emerged: energy companies partnering with electrolyzer manufacturers; utilities collaborating with industrial consumers; and sovereign wealth funds co-investing with technology providers.

The financing challenge remains substantial—individual PtX facilities can require $500 million to several billion dollars in capital investment. Blended finance structures combining commercial debt, development finance institutions, export credit agencies, and government subsidies have proven essential for first-mover projects. As the sector matures and operational track records develop, purely commercial financing becomes increasingly viable.

Conclusion

Green Fuel Technologies, particularly the Power-to-X renewable electricity conversion pathway, represent not a theoretical future but an operational present rapidly scaling toward industrial necessity. The technical fundamentals are proven: renewable electricity converts to green hydrogen via electrolysis; hydrogen synthesizes into ammonia, methanol, or complex hydrocarbons; these fuels power ships, aircraft, and industrial processes without net carbon emissions.

The economic fundamentals continue improving: renewable electricity costs have plummeted; electrolyzer costs decline steadily; synthesis processes mature. Policy momentum builds across major economies through mandates, carbon pricing, and direct subsidies. First-mover projects transition from pilot demonstrations to commercial-scale facilities, with gigawatt-scale deployments planned across optimal global locations.

Most critically, Power-to-X addresses an inescapable reality: electrification cannot decarbonize everything. Ships crossing oceans require energy-dense liquid or compressed fuels. Aircraft need lightweight, high-energy cargo. Steel furnaces and ammonia synthesis demand high-temperature process heat and hydrogen feedstock. Long-term energy storage balances seasonal renewable variation. These sectors represent roughly 30% of global carbon emissions and cannot await battery breakthroughs unlikely to overcome fundamental physics constraints.

Converting renewable electricity to fuels is not a choice but an essential pathway for sectors where direct electrification proves impossible. The question shifts from "whether" to "how quickly" we can deploy green fuel technologies at climate-relevant scales. Success requires coordinated action: governments establishing stable policy frameworks, investors deploying capital patient enough for infrastructure-scale returns, technology providers aggressively scaling manufacturing, and end-users committing to long-term off-take despite cost premiums.

The pathway is clear. The technology works. The urgency is undeniable. Now comes implementation—transforming technical potential into megatonnes of carbon-neutral fuels replacing fossil alternatives and enabling genuine decarbonization across the global economy.

Frequently Asked Questions (FAQ)

Q1: What is the primary difference between Green Hydrogen and Power-to-X?

Green hydrogen is a single product—hydrogen produced via electrolysis powered by renewable electricity. Power-to-X is a broader concept encompassing the entire pathway of converting renewable electricity into various energy carriers and chemical products. Green hydrogen serves as the foundational input for PtX, which then continues to synthesize more complex molecules like ammonia, methanol, or synthetic liquid fuels. Think of green hydrogen as the ingredient, and PtX as the complete recipe creating diverse end products.

Q2: Why can't we just use batteries instead of green fuels for ships and planes?

Energy density creates the fundamental constraint. Aviation fuel contains approximately 12,000 watt-hours per kilogram; the best lithium-ion batteries achieve roughly 250-300 watt-hours per kilogram—a 40-50 times difference. A long-haul aircraft would require battery packs weighing more than its maximum takeoff weight, making flight physically impossible. Similarly, container ships need 20-40 megawatt-hours of energy daily; battery systems of this scale would consume cargo space, add tremendous weight, and require impractically long charging times at ports. Green fuel technologies maintain the energy density advantages of liquid fuels while achieving carbon neutrality.

Q3: How does Power-to-X contribute to energy storage and grid stability?

Renewable energy generation often exceeds immediate grid demand—think midday solar surplus or overnight wind production. Rather than curtailing this excess generation (wasting potential clean energy), Power-to-X systems convert surplus electricity into storable chemical energy. These fuels can be stored for weeks or months, then either used directly as transportation fuels or reconverted to electricity when renewable generation falls short of demand. This provides seasonal energy storage far more cost-effectively than massive battery installations, which excel at hourly or daily storage but become economically impractical for longer durations.

Q4: What makes green ammonia attractive as a marine fuel compared to other green fuel options?

Green ammonia offers several compelling advantages for maritime applications.

First, it contains zero carbon atoms, eliminating CO₂ emissions entirely (though requiring careful management of potential nitrogen oxide emissions).

Second, ammonia liquefies at relatively modest conditions—either moderate pressure at ambient temperature or -33°C at atmospheric pressure—making it far easier to store and handle than hydrogen, which requires extreme pressure or cryogenic temperatures.

Third, global ammonia production and distribution infrastructure already exists for the fertilizer industry, requiring expansion rather than creation from zero. Fourth, ammonia combustion engines and fuel cells for ships are reaching commercial maturity, with multiple shipbuilders offering ammonia-powered vessels. These factors combine to position green ammonia as a leading carbon-neutral fuel technology for international shipping.

Q5: What are the main barriers preventing Power-to-X fuels from competing with conventional fossil fuels on price?

Three primary factors create the current cost gap.

First, green fuel technologies require substantial upfront capital investment in renewable generation, electrolyzers, and synthesis equipment, which must be amortized across production volumes. Fossil fuel infrastructure developed over decades and benefits from massive existing capital base.

Second, renewable electricity costs, while declining dramatically, still average higher than the wholesale natural gas or coal powering conventional fuel production in many regions.

Third, carbon pricing remains absent or insufficient in most global markets, meaning fossil fuels don't bear the environmental cost of their emissions. As renewable electricity costs continue falling, electrolyzer costs decline through manufacturing scale-up, carbon pricing expands globally, and policy mandates create guaranteed demand enabling large-scale production facilities, PtX fuels approach cost parity. Industry projections suggest this occurs around 2030-2035 for early products like green ammonia in optimal locations, with aviation fuels requiring longer timelines or stronger policy support.

References:

This article draws upon research and industry data from multiple authoritative sources to ensure accuracy and credibility:

International Renewable Energy Agency (IRENA) - Comprehensive reports on renewable hydrogen costs, green hydrogen production forecasts, and Power-to-X deployment pathways: https://www.irena.org

International Energy Agency (IEA) - Global hydrogen review, synthetic fuels market analysis, and decarbonization pathway assessments: https://www.iea.org

Bloomberg New Energy Finance (BNEF) - Market intelligence on electrolyzer costs, green hydrogen production economics, and renewable energy pricing trends: https://about.bnef.com

International Maritime Organization (IMO) - Regulations on maritime emissions reduction targets and alternative fuel standards: https://www.imo.org

Hydrogen Council - Industry consortium reports on hydrogen applications, cost projections, and deployment scenarios: https://hydrogencouncil.com

European Commission - Clean Energy & Climate Action - Policy frameworks for ReFuelEU Aviation, FuelEU Maritime, and renewable hydrogen mandates: https://energy.ec.europa.eu

India Ministry of New & Renewable Energy - National Green Hydrogen Mission details, targets, and incentive structures: https://mnre.gov.in

For readers seeking deeper technical understanding, peer-reviewed journals including Nature Energy, Energy & Environmental Science, and Applied Energy regularly publish research on Power-to-X technologies, electrolyzer advancements, and synthetic fuel production pathways.

About Green Fuel Journal

Green Fuel Journal is an independent sustainability publication dedicated to advancing awareness of renewable energy transitions, clean transportation technologies, and environmental policy innovation. Our mission is to inspire evidence-based action for a cleaner, smarter, and more resilient planet.

We provide in-depth analysis, educational resources, and expert commentary on renewable energy, sustainable transportation, and emerging green fuel technologies. Our coverage spans solar power, wind energy, energy storage, green hydrogen, Power-to-X fuels, fuel cells, biofuels, and the policies shaping the global clean-energy future.

Editorial: Green Fuel Journal Research Division Website: www.greenfueljournal.com

Disclaimer: This article — “Power-to-X: Converting Renewable Electricity into Green Fuels” — is for informational purposes only. Cost projections, technology readiness assessments, and market forecasts are based on current data and expert analyses but are subject to change with technological developments, policy shifts, and market dynamics. Organizations should conduct thorough due diligence and consult qualified technical and financial advisors before making investment decisions related to these technologies.

Last Updated: November 2025

© 2025 Green Fuel Journal Research Division. All rights reserved.

Comments