Global Renewable Energy Projects Breakthroughs 2025: Innovations, Investments & the Road Ahead

- Green Fuel Journal

- Nov 5, 2025

- 6 min read

Why $2 Trillion in Clean Energy Investment Matters (and What Comes Next in the Renewable Energy Projects)

By the Green Fuel Journal News Analysis Division Author Credit: News Analysis Team — Green Fuel Journal Date of Review: November 05, 2025

Original News Link: https://news.climate.columbia.edu/2025/04/22/renewable-energy-around-the-world/

Article Summary

The article highlights how the global renewable energy sector is no longer niche but mainstream, pointing to more than $2 trillion invested in the low-carbon transition in 2024.

Renewables now account for approximately 30 % of global electricity generation, then visits five major projects:

Noor Ouarzazate Solar Power Station (Morocco) — a 580 MW Concentrated Solar Power (CSP) facility with embedded molten-salt storage.

Three Gorges Dam (China) — 22.5 GW hydroelectric, illustrating scale but also socio-environmental complexity.

Alta Wind Energy Center (USA) — 1.55 GW onshore wind farm with transmission integration in California.

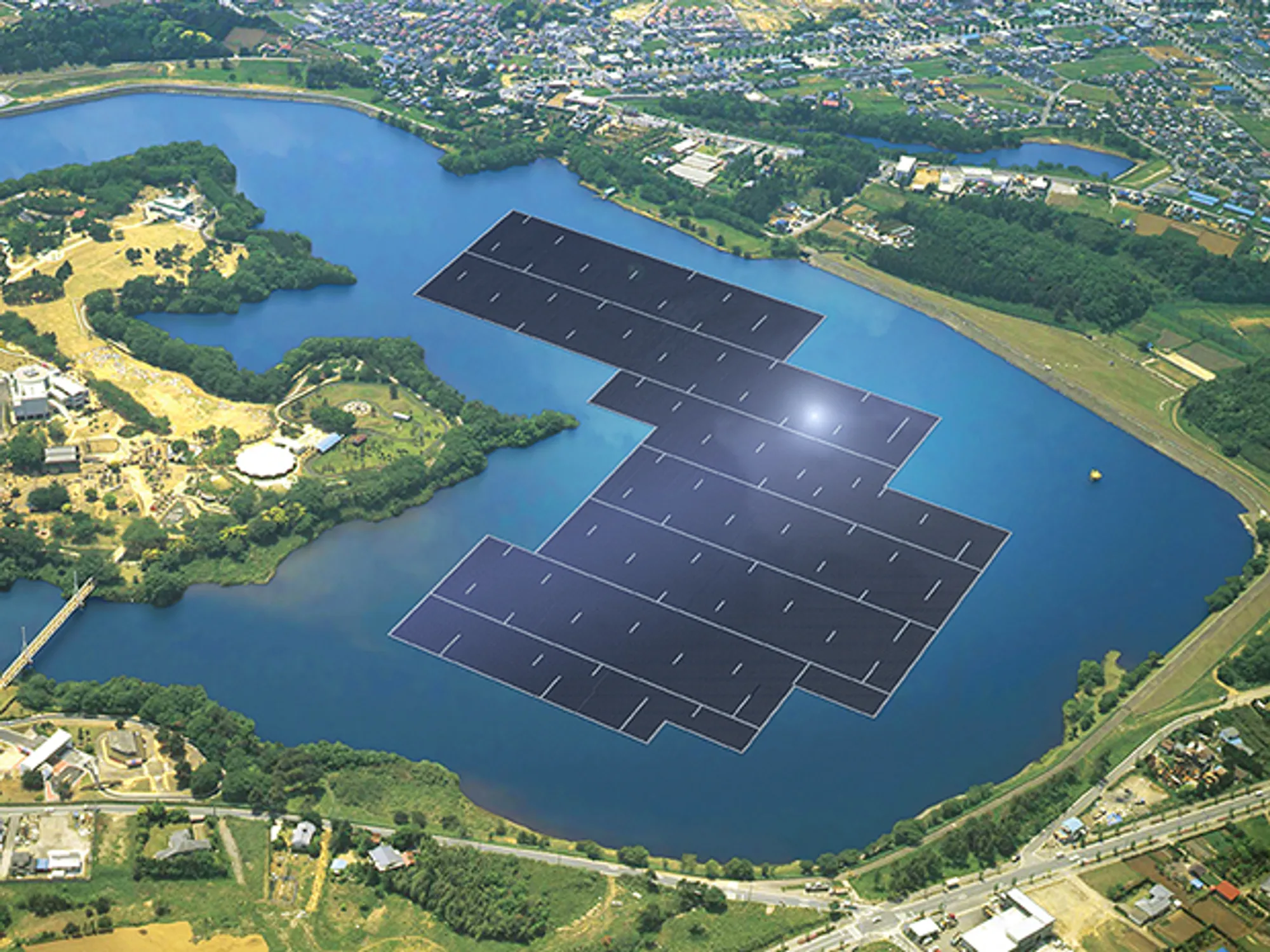

Yamakura Dam Floating Solar Plant (Japan) — 13.7 MW floating solar PV, leveraging scarce land.

Hellisheiði Power Station (Iceland) — 303 MW geothermal plus carbon capture and storage via the CarbFix project. The piece concludes by citing projections from the International Energy Agency (IEA) that global renewable capacity is set to nearly triple by 2030. emphasizes that renewables are not only about climate but also about energy security, economic resilience and technology innovation.

Analyst’s Insight: Context & Implications

3.1 Technological & Investment Upswing

The article’s key framing — $2 trillion in 2024 low-carbon investment and 30 % generation share — signals that we’re entering a “green energy industrial era”, not just pilot projects. This aligns with other data: for example, IEA’s World Energy Outlook, Bloomberg NEF, etc. The scale and diversity of project types (CSP + molten salt, hydro, wind, floating solar, geothermal/CCS) illustrate the maturity breadth of renewables.→ For investors & policymakers: the risk profile is shifting — from “first mover” to “scale & integration” risk (grid, storage, supply chains, permitting).

3.2 Energy Security, Not Just Climate

The article correctly emphasises the strategic dimension: renewables reduce reliance on fossil fuel imports, boost domestic resilience, and enable new export models. In the Morocco case, this is particularly relevant: high‐risk emerging economy financing overcame barriers via multilateral institutions (AfDB, World Bank). → Implication for policy: Developed countries cannot entirely rely on domestic build-out; financing emerging markets is crucial for global decarbonisation, and that financing must move from concessional to commercial terms.

3.3 Challenges: Permitting, Land, Socio-Environmental Impacts

While the headline is optimistic, the underlying projects show clear tensions:

Three Gorges Dam: Displacement of 1.3 million people, ecological erosion, even induced seismicity.

Alta Wind: local zoning and transmission remain hurdles.

For emerging markets (e.g., Africa in the Morocco case): structural biases and investor risk remain. → Implication: the “E” (environmental) and “S” (social) in ESG remain front-and-centre; future scale will depend not only on technology but on permitting, community consent, land use, and grid integration.

3.4 Storage, Dispatchability & New Forms

The CSP plant with molten salt storage in Morocco is a strong proof point: it shows that “intermittent” renewables are being complemented by storage/thermal dispatch. Similarly, the Iceland geothermal + permanent CO₂ mineral storage shows integration of renewables with carbon capture and storage (CCS) — moving beyond just generation to system-level solutions.→ Implication: The next frontier is not mere capacity build-out, but flexibility, integration, system solutions (storage, smart grids, demand response, hybrid systems). Investors and engineers must shift to “energy system thinking”.

3.5 Geographic & Technology Diversification

The five projects span continents and technologies, which underlines a broader truth: no single renewable path+region will suffice for global decarbonisation. Versatility is essential.→ Implication: Countries and companies must avoid technology lock-in; policy and investment should diversify across solar, wind, geothermal, floating PV, hydro, storage, transmission.

4. Technical / Policy / Market Breakdown

Technical Highlights

CSP + Molten Salt (Morocco): Thermal energy storage enables “dispatchable” solar. The article explains the advantage of CSP over PV in terms of storage

Floating Solar (Japan): Utilises reservoir surfaces to bypass land constraints, improves panel efficiency due to cooling, and reduces evaporation losses.

Geothermal + Mineral CO₂ Storage (Iceland): Direct air capture plus mineral‐sequestration of CO₂ (CarbFix) sets a precedent for geothermal‐embedded CCS.

Wind + Transmission (US): The Alta wind farm example underscores that generation alone is insufficient; transmission infrastructure (Tehachapi Renewable Transmission Project) is critical for delivery.

Policy & Market Insights

Financing in emerging markets remains a bottleneck: in Morocco’s case, international finance filled the gap.

Permitting and local zoning remain major obstacles in mature markets (USA case).

Large hydro (Three Gorges) while renewable, comes with social/environmental externalities: displacement, ecosystem alteration, induced seismicity.

Market Outlook & Trends

Tripling of global renewables capacity by 2030 (IEA projection) implies an annual growth rate significantly higher than historical norms.

The shift from “nice to have” environmental asset to mainstream infrastructure: renewables will increasingly be assessed on returns, system integration, and reliability, not just carbon-reduction.

Supply-chain, grid, financing, raw-material constraints (rare earths, silicon, copper, aluminium) will become binding.

Permitting and regulatory reform will be pivotal: even when projects make economic sense, regulatory drag can slow them down (US, Europe examples).

5. Future Indications (Scenarios to Watch)

Near-Term (2025-2030)

Growth in Dispatchable Renewables & Storage: Expect more CSP + molten salt, large BESS (Battery Energy Storage Systems), hybrid solar/wind/storage plants.

Emerging Markets Leapfrogging: Countries in Africa, Southeast Asia, Latin America will increasingly adopt floating solar, geothermal, mini-grid renewables fast, especially where land is constrained or fossil imports expensive.

Permitting Reform & Transmission Build-out: In major economies like the US, Europe, India, permitting reform will become a strategic bottleneck; transmission corridors and grid upgrades will be a key investment area.

Integration of CCS and Renewable Generation: Projects like Hellisheiði suggest more geothermal + CCS or wind/solar + CCS hybrids will emerge.

Diversified Financing Models: More blended finance, public-private partnerships, green/hybrid bonds will be used in riskier markets to unlock capital.

Medium-Term (2030-2040)

“System” Companies Emerge: Energy companies will transition from pure generation to integrated service providers (generation + storage + grid + demand-response + VPPs).

Massive Scaling, but Bottlenecks Appear: Despite growth, raw-material shortages (e.g., lithium, cobalt, rare earths), transmission build-out, recycling of solar/wind will become urgent.

Emergence of Renewables Export Hubs: Regions with abundant sun/wind/geothermal (North Africa, Australia, Middle East, Iceland-type) will become clean-energy exporters (hydrogen, synthetic fuels, grid interconnectors).

Policy & Nature-based Balance Critical: Large-scale projects will face increasing scrutiny about land use, biodiversity, community impacts. Responsible expansion will differentiate winners from laggards.

Carbon Capture + Negative Emissions Pairing with Renewables: To meet 1.5 °C goals, renewables alone aren’t enough; we will see more carbon-removal technologies embedded in clean-energy infrastructure.

Wildcard Trends

Floating Solar Massive Uptick: The article notes the potential of 400 GW from floating solar alone (if just 10 % of 6,600 water bodies globally used).

Geo-engineering Adjuncts: Projects like CarbFix hint that geological solutions to CO₂ could become mainstream, tied to clean-energy sites.

Digital/AI + Energy Integration: Not discussed in detail in the article but implied by scale: AI/data centres + renewables will accelerate system optimisation, demand-side flexibility.

6. Key Takeaways Box

Renewables = mainstream infrastructure: The sector is no longer niche; >30 % of electricity generation globally is now from renewables and investment topped $2 trillion in 2024.

Diverse technologies matter: CSP, floating solar, geothermal+CCS, onshore wind, hydro — multiple pathways are required for global decarbonisation.

Financing and risk are shifting: Emerging markets still need structured finance + de-risking; permitting and grid integration remain major bottlenecks in developed markets.

System integration is the next frontier: Storage, dispatchability, transmission, flexibility will determine not just how much capacity but how reliable it is.

Scale with caution: Large-scale projects (e.g., hydro) deliver volume but also significant environmental and social costs — the expansion of renewables must align with sustainability, land use, community rights.

Geographic opportunities expanding: Regions with solar/wind/geothermal potential and land constraints (or fossil import dependencies) will be growth hotspots (Africa, Southeast Asia, Latin America).

2030-2040 defined by systems, exports and value-added: Renewables build-out will move to hydrogen, synthetic fuels, energy exports, and integrated service models, not just kilowatt-hours.

7. Conclusion

The article from Columbia Climate School paints a compelling picture: renewable energy is accelerating in scale, diversity and global reach. Yet as we see in the projects cited, the next phase will be shaped less by mere capacity additions and more by integration, system flexibility, finance innovation and regulatory reform.

For decision-makers, this means the “easy wins” of solar and wind build-out are behind us. The front‐line is now about unlocking transmission, financing in high-risk markets, enabling storage/dispatchability, and ensuring that expansion is socially and environmentally sustainable.

For industry and investors, the message is clear: look beyond MW counts — think in terms of system value, grid resilience, and business models that embed renewables as the backbone of energy services.

For policy: Getting transmission, permitting and community processes right will be the litmus test of whether this moment becomes a just and enduring transition — or stalls under social, financial and regulatory bottlenecks.

Disclaimer:

The information provided in this article is for general informational and educational purposes only. While every effort has been made to ensure accuracy, completeness and relevance to current conditions, it should not be considered professional advice or a guarantee of future results. The authors and Green Fuel Journal accept no liability for any errors, omissions or for any outcomes arising from applying the information contained herein. Any views or opinions expressed are those of the author in their capacity as an analyst, and should not be taken as financial, legal, or technical advice. Readers are encouraged to conduct their own due diligence and consult qualified professionals before making any decisions based on this content.

Comments